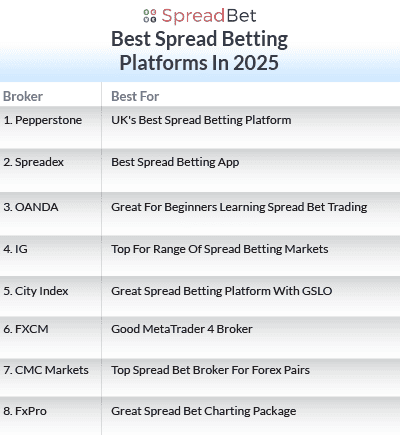

Best Spread Betting Platforms In The UK

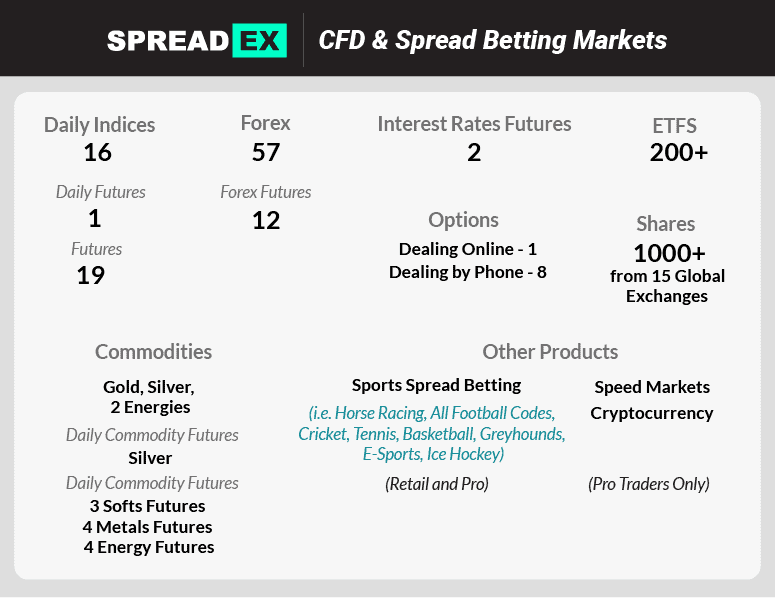

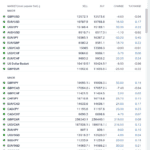

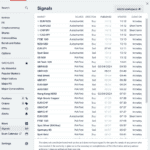

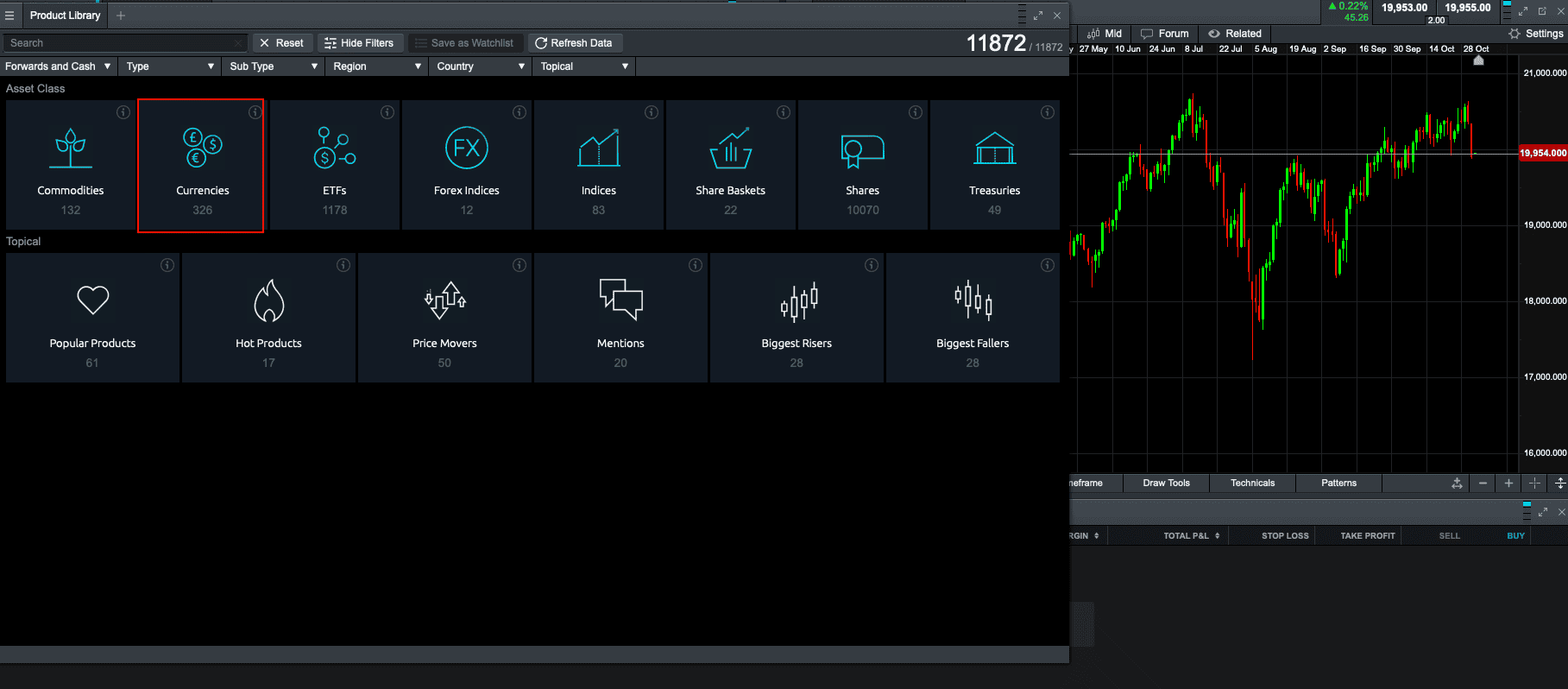

We tested all 16 FCA-regulated brokers to identify the best UK spread betting platform. The team compared trading fees, range of markets and the spread bet platforms offered.

Our spread bet content is supported and we may receive payment when you visit a partner site.

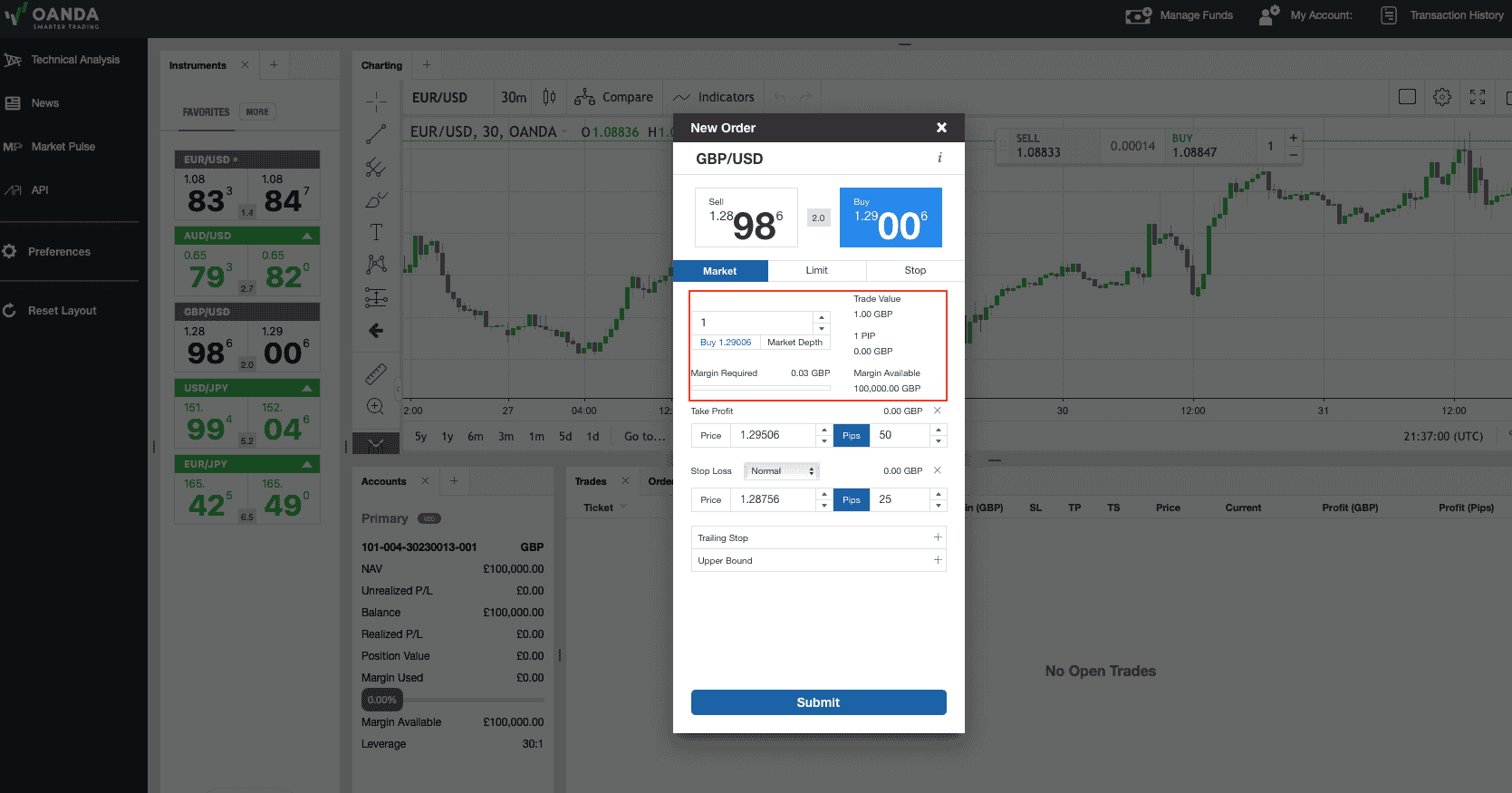

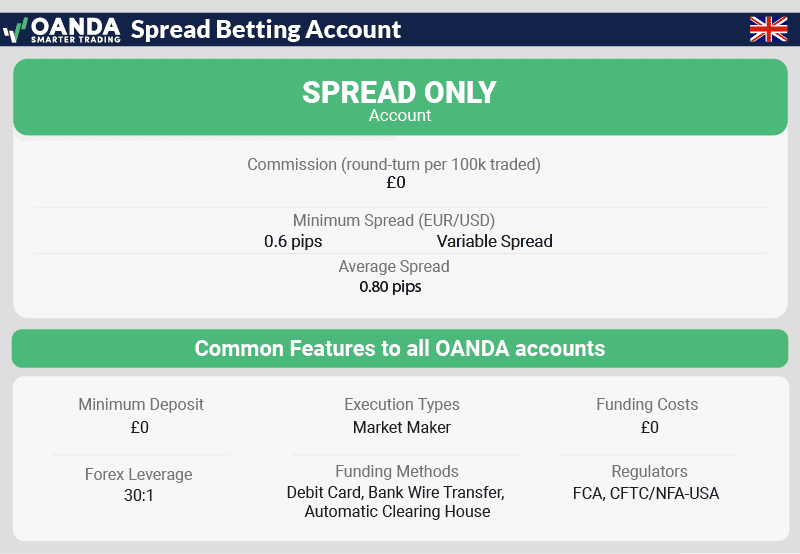

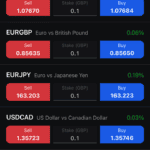

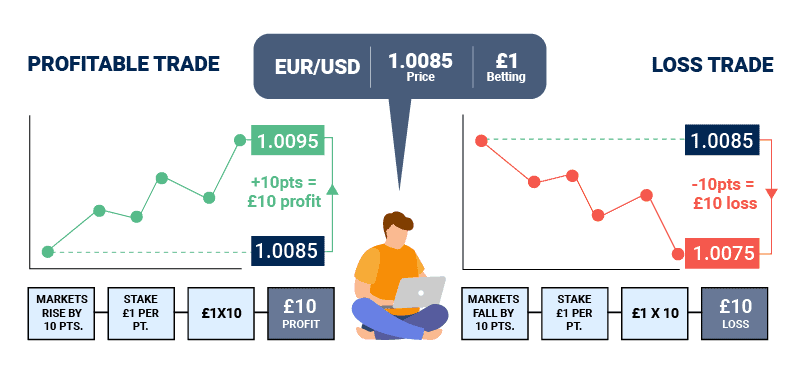

This is actually something we value really highly as traders ourselves. These relatively small differences in spreads add up to a serious amount of money – if you’re saving around 30% on each trade, this translates to a huge saving over multiple trades.

This is actually something we value really highly as traders ourselves. These relatively small differences in spreads add up to a serious amount of money – if you’re saving around 30% on each trade, this translates to a huge saving over multiple trades.

Ask an Expert

What’s the best platform for spread betting?

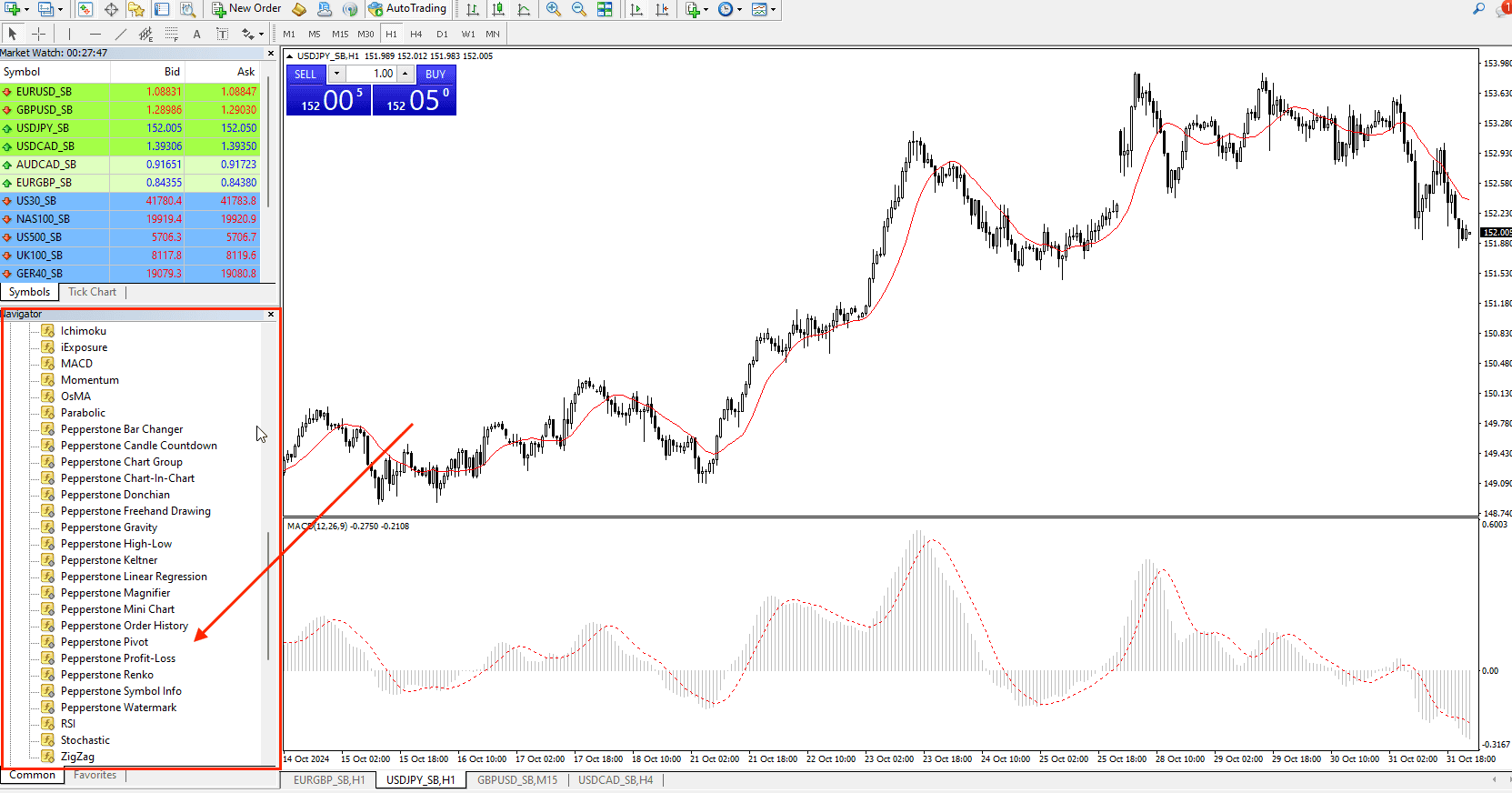

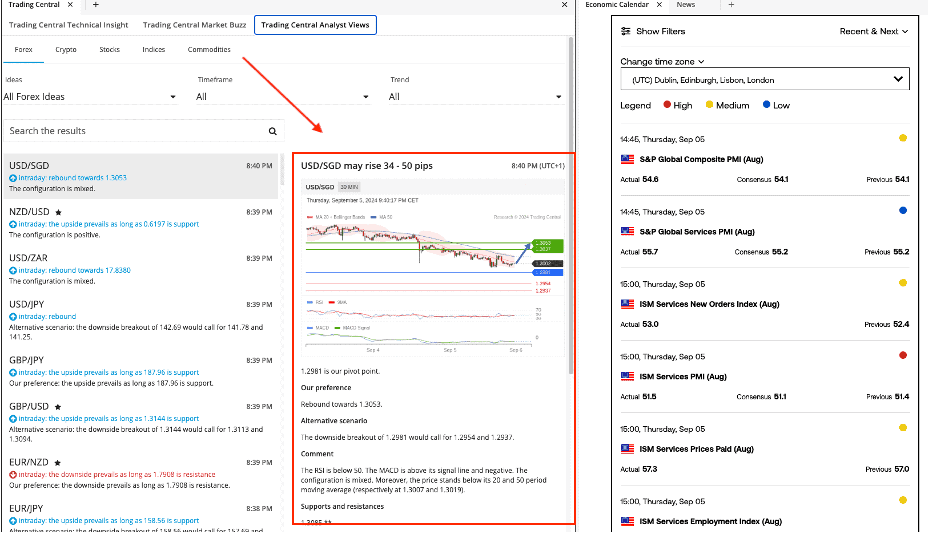

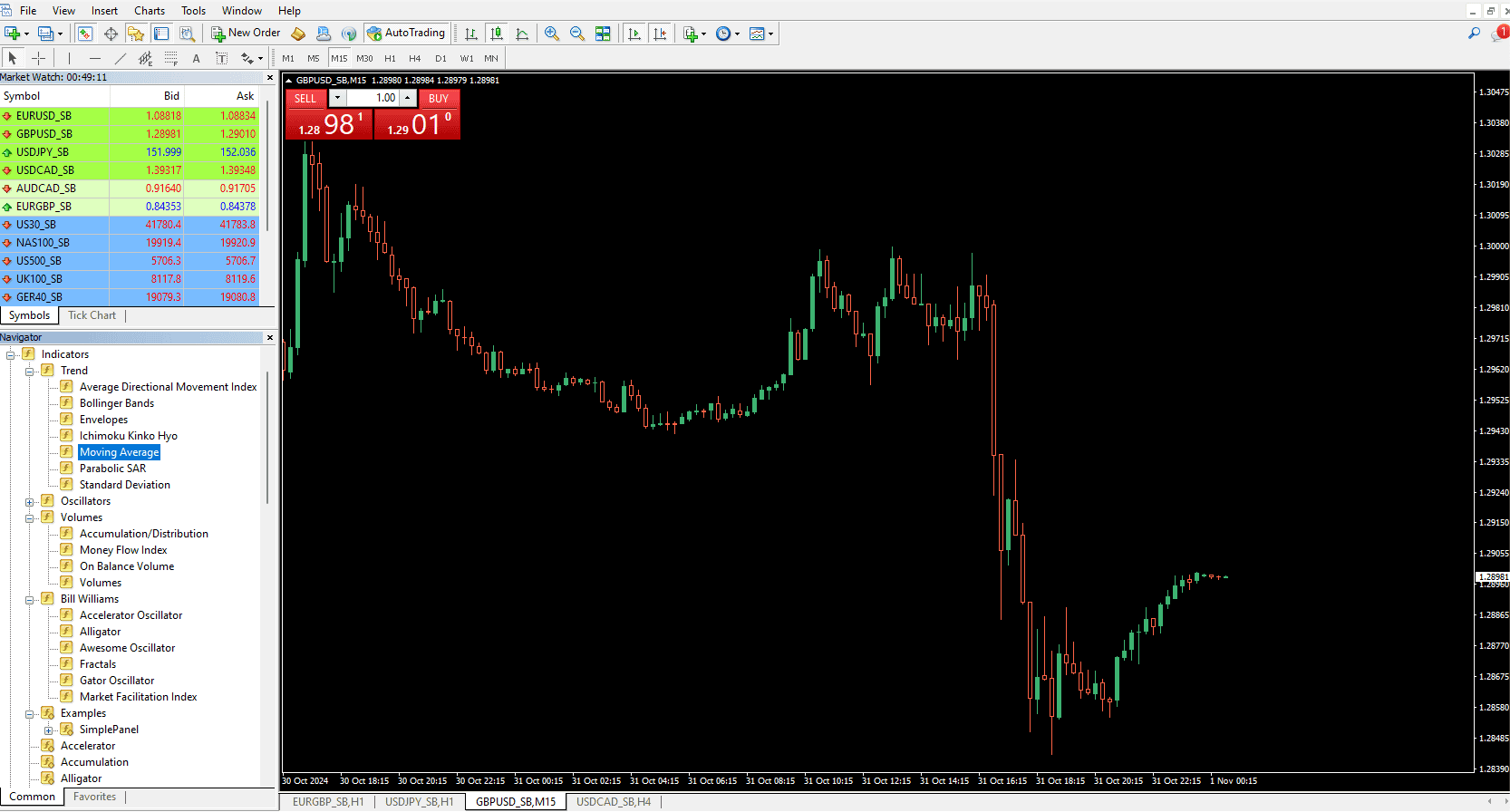

We view TradingView as the best software to spread bet. If your focusing just on trading currency then MetaTrader 4 should also be considered.

What’s the minimum deposit for spread betting account?

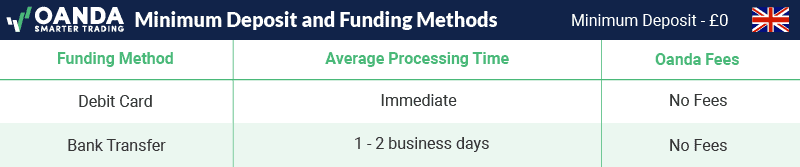

The minimum deposit is between £0 and £200 depending on the broker. For our recommended spread bet broker (Pepperstone) it’s £0.

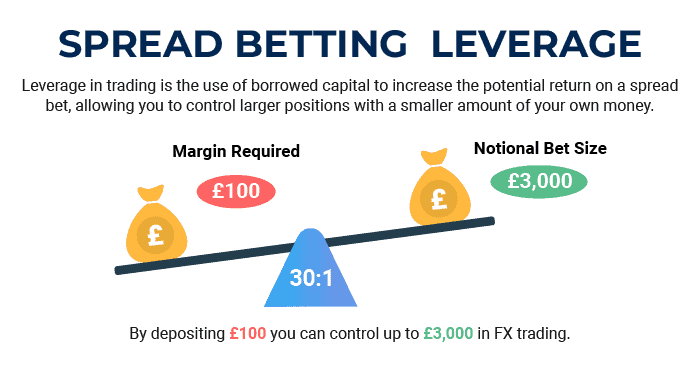

How can I access higher leverage as 30:1 is too low?

All spread bet companies offer a professional account that can increase leverage from 30:1 to 500:1. Just remember, these trading accounts are for professionals so you need to apply and qualify to get access to these facilities.

Are there any spread betting companies outside of the UK?

AvaTrade is the only broker not regulated by the FCA but rather the CBI in Ireland. We ranked the provider the 5th worse of the 16 we evaluated primarily due to their high trading fees.